Lire cet ebook en Français ![]()

The Crucial Role of Analytics Quality

in the Financial Services Industry

Understanding the importance of Data Analytics quality in a highly regulated industry in order to ensure trust, meet regulatory requirements, and mitigate risks.

There Is Simply No Room For Error

The Financial Services industry (FSI) is leveraging data analytics now more than ever in order to make important decisions and execute its strategic plans. Financial and insurance organizations are highly complex and controlled with always more stringent regulations being put in place, and therefore simply cannot afford to report on bad data analytics or worse share it with external stakeholders. Equally, unexpected challenges such as a pandemic, an economic downturn, or a debt crisis heighten this risk of sharing poor data analytics. The fact is, there is just no room for error. Ever.

At Wiiisdom, our mission is to help people make decisions based on trusted data analytics. We help financial organizations ensure high Analytics quality, cost reduction, and risk mitigation through the AnalyticsOps framework. By applying this framework, these organizations can offer a better service to their customers, identify new business opportunities and stay compliant with regulatory requirements.

What is AnalyticsOps?

AnalyticsOps is a combination of methodologies and tools that tremendously increase Analytics Quality, fasten time-to-value, decrease manual-generated risks, and scale Analytics operations. Inspired by the DataOps (aka data quality) and DevOps (aka software/app quality) methodologies, AnalyticsOps (aka reporting quality) focuses on automation to be able to validate and analyze the quality of the data in the last mile of the data journey. This framework allows organizations to ensure trusted Analytics and reduce the risk of poor decision-making.

The Role Of Data Analytics In The Financial Services Industry

Today financial institutions cannot afford to gamble on ungoverned Analytics due to the heavy reliance on it for their success. This industry has very stringent regulations, and so their data Analytics cannot be looking worse for wear because one single error, as small as it may be, could be disastrous for an organization. In this industry, data Analytics is mainly used in risk, supply, demand, and regulatory management.

Risk

- Fraud detection

- Credit risk analysis

- Liquidity risk analysis

Supply

- Sales performance

- Branch performance analysis

Demand

- Recommendation engines to attract new customers

- Lifetime value prediction

Regulatory Reporting

This one is external, most critical

- Regulatory reporting – mainly to supervisors

- Financial reporting – mainly to investors and creditors

The Line of Business of these financial organizations uses these to make decisions for growth and profitability. For any customer transaction, regulatory report, and strategic investment decision, absolute accuracy is imperative, therefore the need for an absolute error-free environment is critical. Analytics quality cannot be played with here.

Data Analytics Challenges Facing Financial Institutions

Making decisions in the Financial Services Industry requires quick, accurate, and relevant data Analytics at all times, whether it’s data visualizations for credit card purchases, branch activity, or mortgages. According to a survey on the global state of enterprise analytics, 56% of people said data Analytics led to faster, more effective decision-making in their companies. This is all well and good but can the data Analytics actually be trusted to make these decisions? The Financial Services Industry faces several obstacles in being able to use its data analytics in a trusted and governed way:

1. More Stringent Regulatory Requirements

Financial institutions are facing more and more stringent regulations, such as Sarbanes-Oxley, IFRS, FRTB, RFPA, and BCBS 239 (in particular principle 7 on risk-reporting practices). They are spending billions every year on compliance operations and fines. To put this in perspective, the banking industry has spent approximately $270 billion per year since 2008 on compliance-related costs, not forgetting the $321 billion on settlements, enforcement actions, and fines. They use data Analytics to help meet these requirements but one small error could ruin the trust and reputation they’ve built up, not forgetting the hefty fines and bad press.

2. Unprecedented Demands

The use of data Analytics is continually increasing and with that comes the need for faster releases. What before was something that happened quarterly or even longer has now turned into everyday releases. The question that financial and insurance organizations will face is how do they find time to test everything with these unprecedented demands?

3. Customer Expectations

Your customers expect a flawless experience at all times and their Analytics can’t be showing up looking worse for wear. If certain functionalities don’t work or they have doubts about the Analytics provided to them, the risk of poor decision-making, loss of trust, and low user adoption will increase.

4. Technology Changes

Data Analytics is an extremely valuable source for financial institutions and they’re in a technological environment that is forever changing. With tools such as AI, Cloud computing, and robotics, and the reality of having multiple data sources, managing their data Analytics successfully becomes a real challenge.

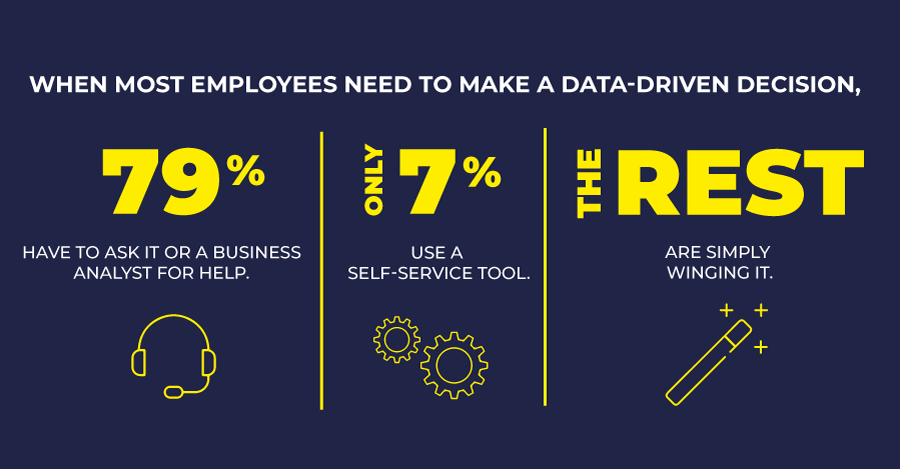

5. Lack of Self-Service Analytics

Allowing self-service Analytics is great but it’s hard for people to make decisions when they don’t have access to the right data Analytics. According to a survey on financial organizations, 20% of people said one of the biggest challenges within their organizations was the lack of self-service Analytics. The lack of data literacy clearly impacts this and organizations need to address this to be able to increase their use of data Analytics for decision-making.

Why Financial Institutions Must Deploy AnalyticsOps

When it comes to the Financial Services Industry, they cannot afford to gamble on ungoverned Analytics. This is why AnalyticsOps is a must and here we’ll explain why:

1. Ensures high Analytics quality

More data Analytics comes with more quality challenges and automated testing is the only way to overcome this. Dealing with this manually is not an option due to the high risks associated with it. In this industry, the regulations are forever increasing and so quality is a must-have to ensure 100% compliance. Industry research by Tricentis states that testing prior to a release is done much more within the financial industry than others, only highlighting, even more, the influence and necessity for high Analytics quality.

2. Provides a first-class user experience

You need to provide Analytics that are easy to use, scalable, and highly available to allow users to make trusted decisions every time. AnalyticsOps ensures the usability and performance of your BI and Analytics platform are at their best so nothing compromises the user experience.

3. Establishes a trusted Analytics culture

The financial landscape includes different types of technologies ranging from legacy platforms such as SAP BusinessObjects to more modern platforms such as Tableau and Microsoft Power BI. With all these different platforms available, the AnalyticsOps framework helps financial institutions consistently ensure their Analytics is meeting stakeholder expectations, regardless of the technology used.

4. Reduces issues and mitigates risks through automation

Automation is a no-brainer when it comes to reducing issues in Analytics and it plays an important role in the successful implementation of AnalyticsOps. Automating operations such as BI testing will help financial organizations mitigate risks in poor-decision making. According to research carried out in the financial industry, 50% of organizations are more likely to have resilient test automation in place highlighting that testing is more of a discipline within this industry. Likewise, those with more automated risk reporting are better able to implement BCBS-239.

5. Decisions can be trusted

Thousands of decisions are made every day in the Financial Services Industry to better serve customers, meet regulations and deliver better products and services. Decisions cannot be made on bad data Analytics, it wouldn’t just be an internal affair, imagine sharing this with external stakeholders or customers. Your brand reputation would be broken. Would you want another Lehman Brothers outcome? If your risk reporting cannot be trusted then this is what could occur. AnalyticsOps however ensures this would never happen.

6. Achieves agility

To have trusted and governed Analytics, organizations need to put in place agile methodologies. Changing user demands and fast-paced market changes mean organizations need to be able to deliver Analytics quicker and resolve bad data before it gets consumed. Agile strategies such as CI/CD and Test-Driven Development must be implemented to help achieve this.

7. Allows for RPA

As the amount of data and information available for decision-making continues to grow, RPA (Robotic Process Automation) is a growing technology in the financial world. It allows robots to execute tasks within the framework of scenarios planned in advance and on the basis of data or events. Imagine triggering the purchase of a currency or changing the rate of an investment based on data present in a table of your BI software. Now imagine the negative consequences that could occur if the data was not tested? AnalyticsOps ensures that you implement routine checks and complex scenarios to avoid automated disasters.

8. Ensures regulatory compliance

With more and more strict industry regulations, compliance is required at all times to ensure the data landscape is governed as well as possible. Even the smallest data regression can cause disastrous consequences for these institutions, resulting in fines and a decline in the institution’s reputation. AnalyticsOps allows you to implement report and dashboard monitoring that includes items subject to regulation (e.g., PII). As an example, AnalyticsOps is a very good way to meet principle 7 of BCBS-239.

9. Guarantees end-to-end governance

Data quality and data governance are not enough. Financial institutions need to go beyond this and ensure Analytics governance and quality. In the BCBS-239 principle, it is crystal clear that Analytics governance and Analytics quality is critical for risk reporting. For example, banks need to invest and mitigate the risk at the Analytics level the way they do at the data level, and this can be achieved by deploying AnalyticsOps. This not only limits the risk inherent to data exploitation, i.e. the technological risk, but also makes reporting on other risks more reliable (financial risk, commercial risk, etc.).

Trusted Analytics Cannot Wait Any Longer

The Financial Services Industry requires AnalyticsOps to ensure its Analytics can be fully trusted by its decision-makers, customers, and partners. Of course, vast progress has been made in data governance by making the data used to build reports more reliable, but there is still a lot to be done on the governance of the reports. The vast majority of reports are still tested manually, and sporadically if at all. Implementing this framework with the use of automation will allow organizations to comply with regulatory requirements, meet customer expectations and mitigate any risks associated with bad data Analytics.

At Wiiisdom, we help Financial Institutions offer a better service to their customers, identify new business opportunities, mitigate risks and stay in compliance with regulatory requirements such as the principle 7 of the BCBS-239 by automating all their Analytics operations.

Author: Ailsa Cartledge